Source: Photo from Unsplash.

Source: Photo from Unsplash.

135

Indicators

62

Years

211

Economies

The World Bank curates and maintains a wide range of ESG data for policy makers, financial market participants and academic researchers. Use this portal to explore how countries compare to each other, create country profiles and learn about the latest research on ESG.

Featured items

New

Blog post

With the Earth experiencing rapid changes undermining critical life-support structures, transitioning to a low-carbon, climate-resilient global economy has become urgent. This is reflected in the Paris Agreement, a legally binding treaty of 196 entities under which they have pledged to lower greenhouse gas emissions contributing to climate change. Financial institutions and capital markets—which fund investments into future economic activities—must become a greater force for addressing climate change and encouraging low-carbon growth.

Read more

New

Working paper

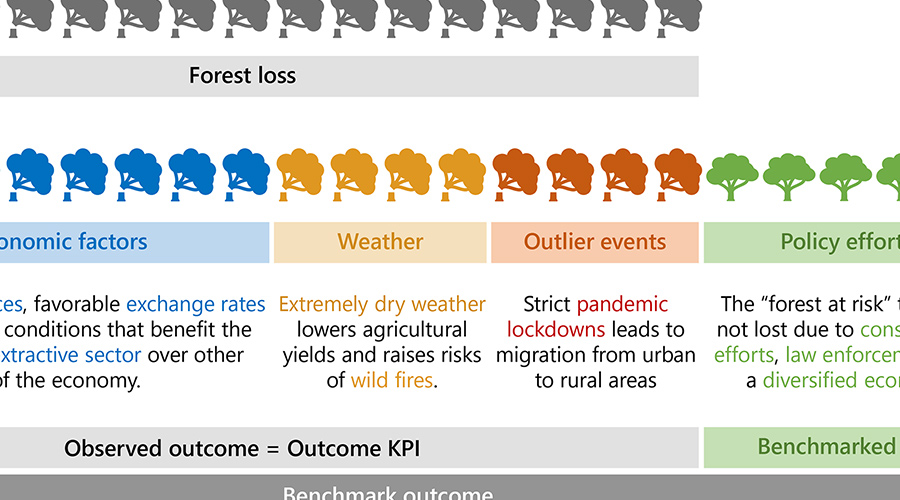

This paper proposes a new relative evaluation and benchmarking framework for performance-linked financing instruments. It argues that the carrots and sticks of sustainability-linked bonds should not use key performance indicators which are solely tied to outcomes. Instead, they should be based on its issuer's level of performance with respect to a target. The paper defines performance as the part of the outcome that the issuer can influence. Otherwise, the issuer may be rewarded or penalized for factors outside their control. In such a case, principal-agent theory would predict a dilution of the performance-based instrument's incentives. This framework is then applied to deforestation in Brazil's Legal Amazon and estimate performance by accounting for the real effective exchange rate, global commodity prices, and prevalent deforestation trends. The results show that policy efforts helped lower deforestation in the 2000s, even after accounting for external factors. The trend reversal and acceleration in deforestation since 2012 are partly due to weaker policy and macroeconomic factors. Based on these results, the paper proposes an Amazon sustainability-linked bond, which could allow for a more effective mechanism to incentivize policy efforts. The paper also introduces the feasibility and ambitiousness matrix to set sustainability performance targets. The matrix is used to define the terms low-hanging fruits and long shots and to discuss why such targets are subject to the risk of greenwashing.

Read more

Blog post

Setting a reachable target has been more art than science. Here at the World Bank, we developed the Feasibility-AmBitiousness (FAB) Matrix to give more structure to the target setting exercise. As the name implies, the FAB Matrix gauges targets along feasibility and ambitiousness dimensions. This helps issuers map out possible blind spots and avoid targets that are vulnerable to greenwashing accusations : i.e. highly ambitious targets may not be feasible (long shots), and, likewise, highly feasible targets may not be ambitious (low-hanging fruits).

Read more

Report

This paper discusses both the relevance of economic and social rights (ESRs) for environmental, social, and governance (ESG) investing in the sovereign debt asset class and how to start incorporating these rights into the investment process in a practical way. Many in the investment industry recognize the potential role that investors can play in influencing a country’s decisions on environmental and social issues, including human rights. Investors are also increasingly acknowledging the potential to influence a sovereign’s actions on social issues, such as ESRs, given the state’s direct role in providing a pathway to social advancement for its citizens. The rest of this paper is organized as follows. Section 2 explains the relevance of ESRs to the sovereign debt asset class. Section 3 introduces the income adjusted ESR dataset, and section 4 illustrates the insights that this dataset can provide for sovereign debt investors. Section 5 provides one practical example of how sovereign debt investors could use such a dataset in practice. Section 6 presents our conclusions.

Read more

Get the latest data stories and updates to the portal

Subscribe to our newsletter

Data stories

New dataset

Drought is a major hydroclimatic hazard, with vast and varied socioeconomic and environmental impacts across the world. Between 1970 and 2019, drought affected about 55 million people every year, leading to significant loss of human life with more than 650,000 deaths

Read more

Putting data to work

The peer comparison method provides a robust, transparent and intuitive way to assess whether a country's sustainability performance was extraordinary or nothing special — compared to its peers. It allows investors to link financial incentives with key performance indicators and reward “better-than-expected” performance.

Read more

Portal update

Since the launch of our Sovereign ESG Data Portal (BETA) back in 2019, the ESG investing space has grown by leaps and bounds. ESG has become such a central point of discussion that it's hard to find a financial newspaper doesn't feature an article about climate, sustainability or green finance on its front page.

Read more

New dataset

The Economic and Social Rights Performance Score is one of the new indicators in the Sovereign ESG data portal. This dataset was developed by the Human Rights Measurment Initiative and that quantifies the Quality of Life across five dimensions. Right to education, right to food, right to health, right to housing and right to work. These scores measure how well a country is using its resources to ensure people's economic and social rights are fulfilled. By nature of its constructuion, the score automatically adjusts for the ingrained income bias.

Read more

Cayman Islands

Cayman Islands

Income classification

High income

Geographic region

Latin America & Caribbean

Climate profile

Tropical

Indicator

Value

Year

Population, total

68,706

2022

Population growth (annual %)

0.83%

2022

Surface area (sq. km)

264

2020

GDP (current US$)

6.03 billion

2021

GDP growth (annual %)

4.03%

2021

GDP per capita (current US$)

88,475.60

2021

Inflation, consumer prices (annual %)

-0.63%

2016

Latest publication

For a full list of our research, see our Publications page.

New

Policy Research Working Paper

Could Sustainability-Linked Bonds Incentivize Lower Deforestation in Brazil’s Legal Amazon?

This paper proposes a new relative evaluation and benchmarking framework for performance-linked financing instruments. It argues that the carrots and sticks of sustainability-linked bonds should not use key performance indicators which are solely tied to outcomes. Instead, they should be based on its issuer's level of performance with respect to a target. The paper defines performance as the part of the outcome that the issuer can influence. Otherwise, the issuer may be rewarded or penalized for factors outside their control. In such a case, principal-agent theory would predict a dilution of the performance-based instrument's incentives. This framework is then applied to deforestation in Brazil's Legal Amazon and estimate performance by accounting for the real effective exchange rate, global commodity prices, and prevalent deforestation trends. The results show that policy efforts helped lower deforestation in the 2000s, even after accounting for external factors. The trend reversal and acceleration in deforestation since 2012 are partly due to weaker policy and macroeconomic factors. Based on these results, the paper proposes an Amazon sustainability-linked bond, which could allow for a more effective mechanism to incentivize policy efforts. The paper also introduces the feasibility and ambitiousness matrix to set sustainability performance targets. The matrix is used to define the terms low-hanging fruits and long shots and to discuss why such targets are subject to the risk of greenwashing.

Sep 04, 2023

Full report