Combating bribery in all its forms

Good governance in regulation, business licensing, taxation, and access to public services is fundamental to a sustainable business environment. Opaque, burdensome, and inefficient regulations and procedures nurture opportunities for corrupt officials to extract bribes or unofficial payments, and Goal 16 seeks to minimize these opportunities (target 16.5).

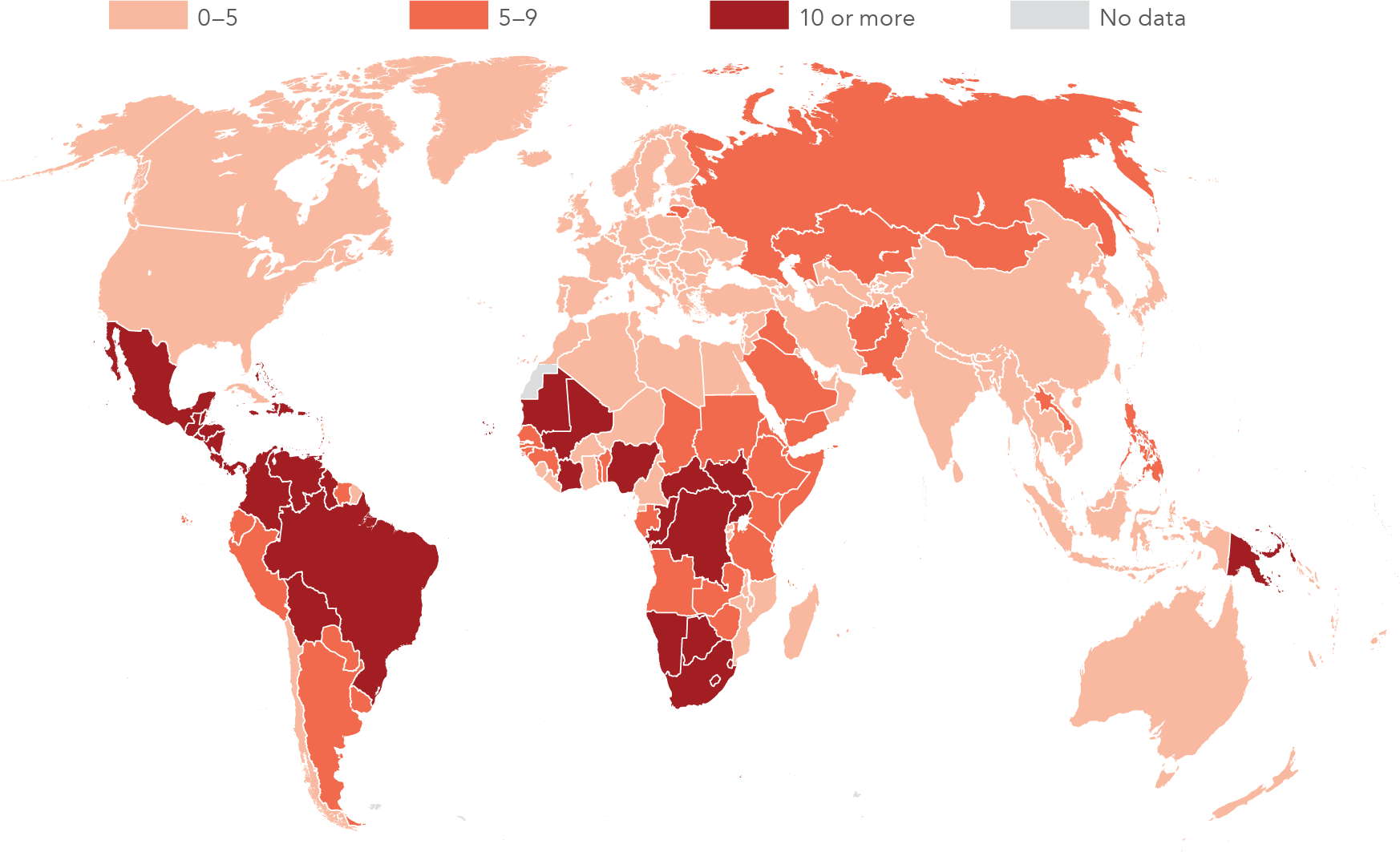

One in four firms in low-income and lower-middle-income countries encounter requests for bribes and informal payments from officials, while one in five are expected to offer gifts to tax officials (figure 16a). Bribery often occurs in transactions necessary for a private firm to conduct business: paying taxes; obtaining an operating license, import license, or construction permit; and obtaining an electrical or water connection.

In the economies worst affected, more than half the firms encounter such requests, adding to their costs (figures 16d and 16e). The requests also impede the creation and growth of firms.

Minimizing violent and conflict-related deaths

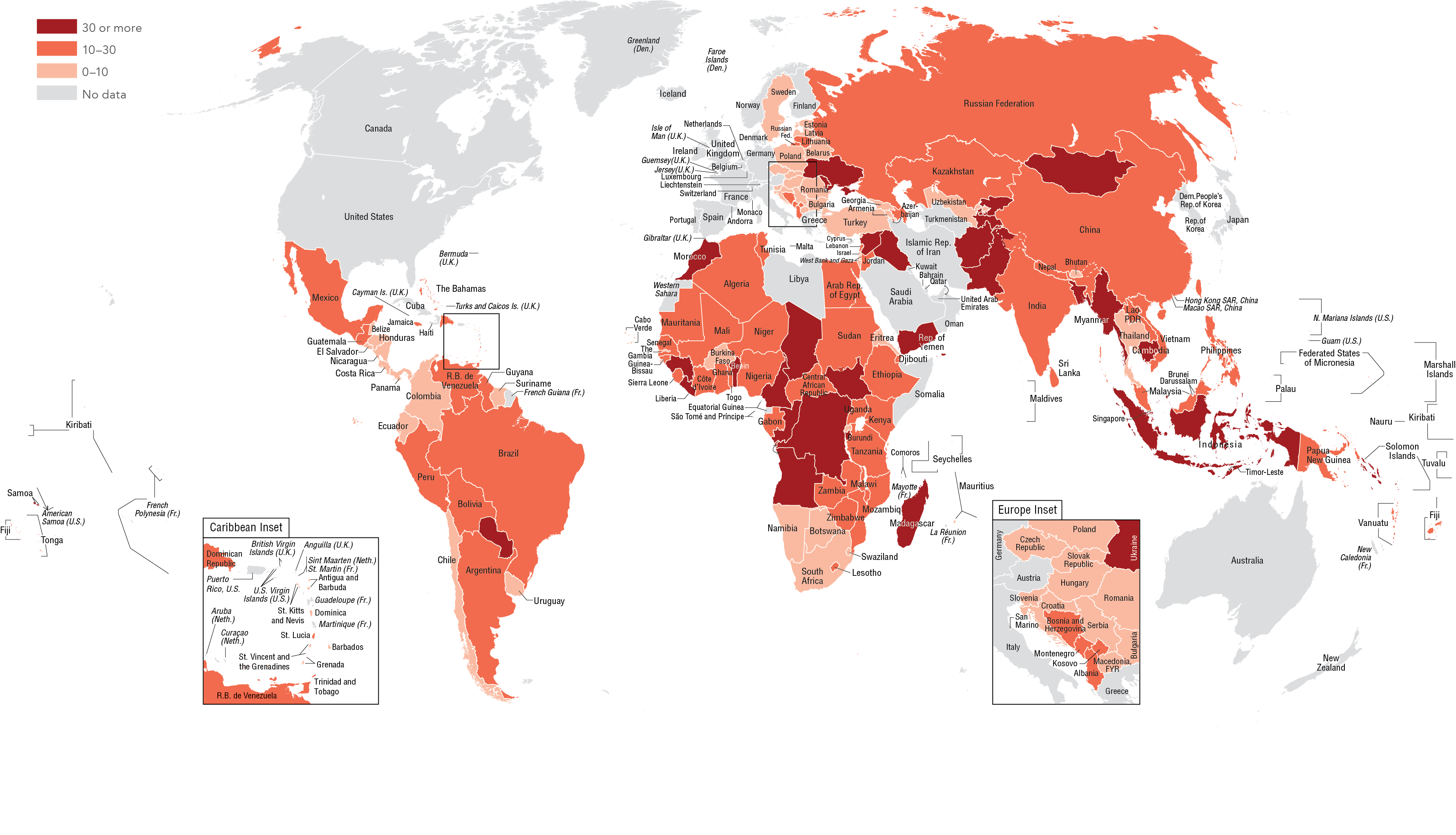

The global rate of intentional homicide fell from 6 per 100,000 people to 5 between 2012 and 2014, showing progress toward Goal 16's aim of greatly reducing all forms of violence and conflict-related deaths (target 16.1). Eight countries in Latin America and the Caribbean were in the top 10, with Honduras the most violent at 70 homicides per 100,000 people (figure 16b). In Sub-Saharan Africa, Lesotho had the most homicides at 38 per 100,000 people.

Most battle-related deaths in 2015 were in Syria, at more than 46,500 Afghanistan saw battle-related deaths escalate to more than 17,200 in 2015. Conflict casualties rose in Yemen too, with around 6,700 deaths in 2015 (figure 16c).

Achieving good budgetary governance

To provide a sound basis for development, government budgets should be comprehensive, transparent, and realistic (target 16.6). The Public Expenditure and Financial Accountability (PEFA) Program identifies how well governments execute their budgets in accord with the appropriations authorized at the beginning of each year. Since 2005, 147 countries and 178 subnational governments have carried out a PEFA assessment, with national spending more likely to be on target than subnational spending.

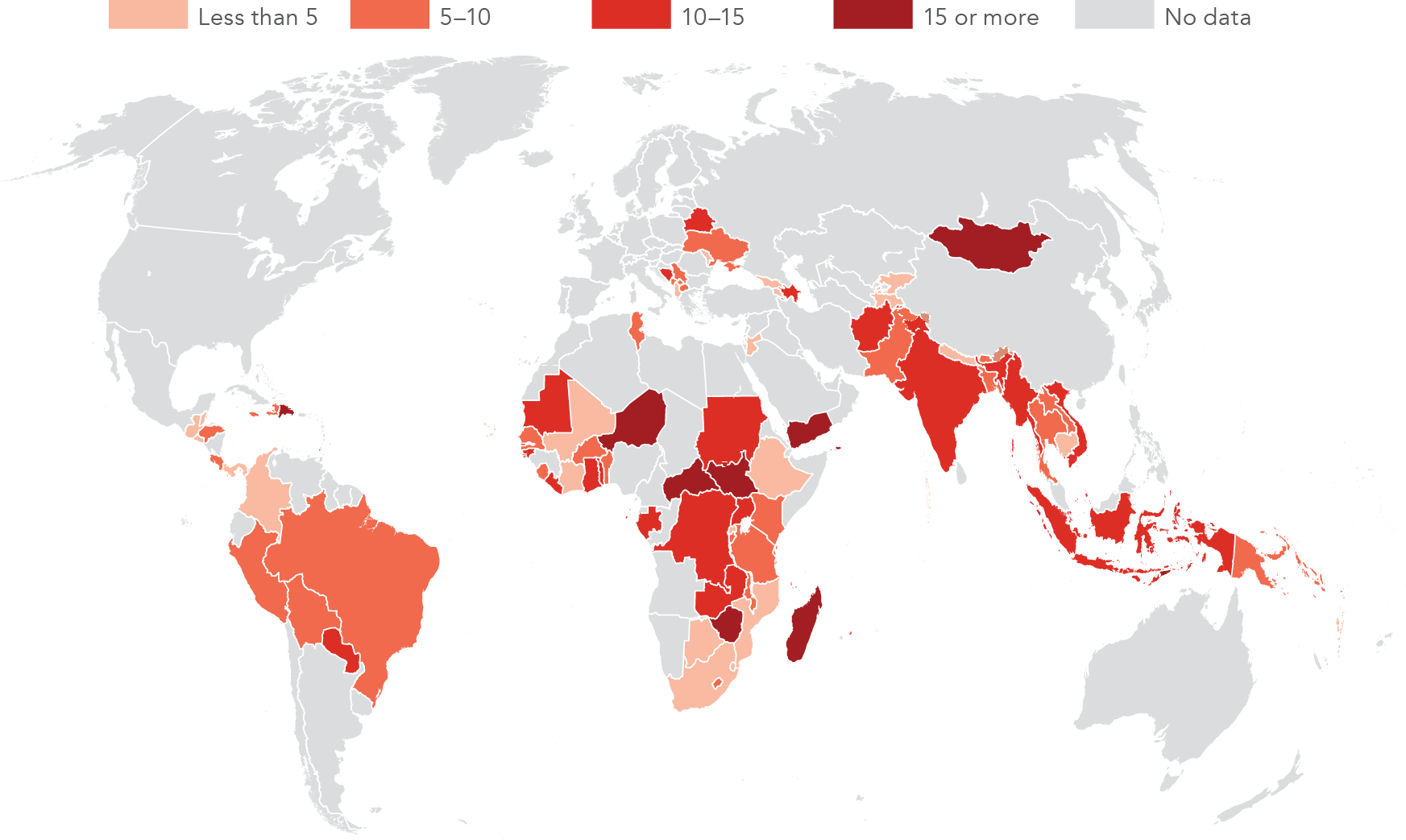

Nearly two-thirds of countries surveyed were within 10 percent of their original national budgets, and nearly half of these were within 5 percent. But nearly one in ten countries assessed deviated by more than 15 percent. Implementing realistic national budgets is particularly challenging in Sub-Saharan Africa, where nearly four-fifths of countries were more than 5 percent off (figure 16f).

Budget reliability has been assessed at least twice in 102 countries since 2005. Around four of five countries in East Asia and Pacific and South Asia showed improvement, while two of five in Sub-Saharan Africa saw their scores deteriorate (figure 16g).

Ranging from large states in Brazil to small municipalities in Croatia, almost half the 178 local government budgets surveyed in 34 countries deviated by more than 15 percent from the original budget, and only one in seven subnational budgets was within 5 percentage points (figure 16h). The link between national and subnational performance is not systematic. But Ethiopia and South Africa are good examples of where the majority of subnational and national budgets were very close to the ones the legislature approved.

Bestowing comprehensive legal identity

Civil registration systems should record major life events such as births, marriages, and deaths for all citizens (target 16.9). But in parts of rural Sub-Saharan Africa, birth registration is lacking: in Somalia, fewer than 2 percent of rural births are recorded, and in Malawi and Ethiopia fewer than 5 percent. Civil registration systems are also lacking in some parts of Asia: Yemen and Pakistan record fewer than a quarter of their rural births (figure 16i).